ARTICLE LINKS

Last week, the U.S. Supreme Court voted to block the Biden administration from enforcing COVID-19 vaccine and testing requirements for large private companies with at least 100 employees. Meanwhile, the Supreme Court allowed a vaccine mandate to stand for medical facilities that take Medicare or Medicaid payments.... Click here for further reading on this topic.

Information (c) Big I Independent Agent (BIIA).

Information (c) Big I Independent Agent (BIIA).

|

The Federal Government is taking Covid-19 protections seriously and holding companies accountable for the safety of their employees. They have issued citations from around 255 inspections that they carried out. The penalties from those inspections were totaling $3,403,139. We at Brock-Norton wanted to pass this info along to keep you informed.

|

Written By: Travelers ©

Several states across the U.S. are providing legislative protections for health care providers and some other businesses against COVID-19-related liability claims, in the absence of any federal action on the matter.

The aim of these laws is to prevent a stream of lawsuits regarding COVID-19 related risks – lawsuits, by individuals seeking damages because they (or a loved one) allegedly contracted COVID-19 when on the organization's premises, that could bankrupt a business.

Currently, the following states have enacted some type of COVID-19 liability shield legislation: Alabama, Alaska, Arkansas, Georgia, Iowa, Kansas, Kentucky, Louisiana, Massachusetts, Mississippi, New Jersey, New York, North Carolina, Ohio, Oklahoma, Tennessee, Utah, Wisconsin, and Wyoming.

The laws vary from state-to-state, causing multi-state organizations to be subject to more than one. Diane Wagner "Georgia businesses get COVID-19 liability shield" northwestgeorgianews.com (Aug. 05, 2020); Jason Hall "Tennessee House, Senate passes COVID-19 Recovery Act" newschannel9.com (Aug. 12, 2020).

Commentary

It is important for organizations to know that these laws do not provide a blanket Covid-19 liability shield.

In general, the laws do not eliminate the duty to maintain a safe environment for those who interact with the employer’s workplace. Employers may not completely disregard health and safety procedures and avoid liability under the acts.

Under the Georgia COVID-19 Pandemic Business Safety Act, for example, plaintiffs may proceed with their claims when they can show the organization’s “gross negligence, willful misconduct, reckless infliction of harm, or intentional infliction of harm”. Absent gross negligence or willful misconduct, covered organizations are shielded from COVID-19 exposure lawsuits.

Additional requirements of plaintiffs can vary. For example, Tennessee’s law requires claimants to file a “certificate of good faith” that states the plaintiff’s counsel consulted with a licensed physician who provided a signed written statement that the COVID-19-related injury was caused by the alleged conduct of the employer.

The Georgia Act does not require such a certificate. It, however, provides for a rebuttable presumption in the absence of gross negligence or willful misconduct that potential plaintiffs assume the risks of COVID-19 related injuries when he or she enters certain organizations that provide express warnings. The Act contains two warnings entities may use, the inclusion of which in the required location and form triggers the rebuttable presumption that the individual assumed the risks of COVID-19 injury when he or she entered the premises.

Even though Georgia places hurdles in front of some plaintiffs, the fact is that this shield law will not affect COVID-19 claims brought by employees against Georgia employers, which claims are governed by Georgia’s workers’ compensation laws. Georgia employees cannot sue their employers for injuries due to negligence but must proceed under the workers’ compensation law.

Organizations should anticipate more COVID-19 liability shield laws and review those laws with legal counsel. Some questions to consider include:

· Is my organization in a jurisdiction with a liability shield law?

· When does the law expire?

· Is my organization one covered by the law or is it just for health care providers?

· What are the protections from potential claimants such as visitors or customers?

· Is there a standard other than gross negligence or willful misconduct?

· Must I post notices and if so, what do they have to say?

· If my organization is not covered by my state’s law, or if I operate in a state without any liability shield law, what other steps should I take

beyond basic COVID-19 health and safety steps such as handwashing, providing hand-sanitizer, requiring facial masks, requiring social distancing, and increasing ventilation?

Several states across the U.S. are providing legislative protections for health care providers and some other businesses against COVID-19-related liability claims, in the absence of any federal action on the matter.

The aim of these laws is to prevent a stream of lawsuits regarding COVID-19 related risks – lawsuits, by individuals seeking damages because they (or a loved one) allegedly contracted COVID-19 when on the organization's premises, that could bankrupt a business.

Currently, the following states have enacted some type of COVID-19 liability shield legislation: Alabama, Alaska, Arkansas, Georgia, Iowa, Kansas, Kentucky, Louisiana, Massachusetts, Mississippi, New Jersey, New York, North Carolina, Ohio, Oklahoma, Tennessee, Utah, Wisconsin, and Wyoming.

The laws vary from state-to-state, causing multi-state organizations to be subject to more than one. Diane Wagner "Georgia businesses get COVID-19 liability shield" northwestgeorgianews.com (Aug. 05, 2020); Jason Hall "Tennessee House, Senate passes COVID-19 Recovery Act" newschannel9.com (Aug. 12, 2020).

Commentary

It is important for organizations to know that these laws do not provide a blanket Covid-19 liability shield.

In general, the laws do not eliminate the duty to maintain a safe environment for those who interact with the employer’s workplace. Employers may not completely disregard health and safety procedures and avoid liability under the acts.

Under the Georgia COVID-19 Pandemic Business Safety Act, for example, plaintiffs may proceed with their claims when they can show the organization’s “gross negligence, willful misconduct, reckless infliction of harm, or intentional infliction of harm”. Absent gross negligence or willful misconduct, covered organizations are shielded from COVID-19 exposure lawsuits.

Additional requirements of plaintiffs can vary. For example, Tennessee’s law requires claimants to file a “certificate of good faith” that states the plaintiff’s counsel consulted with a licensed physician who provided a signed written statement that the COVID-19-related injury was caused by the alleged conduct of the employer.

The Georgia Act does not require such a certificate. It, however, provides for a rebuttable presumption in the absence of gross negligence or willful misconduct that potential plaintiffs assume the risks of COVID-19 related injuries when he or she enters certain organizations that provide express warnings. The Act contains two warnings entities may use, the inclusion of which in the required location and form triggers the rebuttable presumption that the individual assumed the risks of COVID-19 injury when he or she entered the premises.

Even though Georgia places hurdles in front of some plaintiffs, the fact is that this shield law will not affect COVID-19 claims brought by employees against Georgia employers, which claims are governed by Georgia’s workers’ compensation laws. Georgia employees cannot sue their employers for injuries due to negligence but must proceed under the workers’ compensation law.

Organizations should anticipate more COVID-19 liability shield laws and review those laws with legal counsel. Some questions to consider include:

· Is my organization in a jurisdiction with a liability shield law?

· When does the law expire?

· Is my organization one covered by the law or is it just for health care providers?

· What are the protections from potential claimants such as visitors or customers?

· Is there a standard other than gross negligence or willful misconduct?

· Must I post notices and if so, what do they have to say?

· If my organization is not covered by my state’s law, or if I operate in a state without any liability shield law, what other steps should I take

beyond basic COVID-19 health and safety steps such as handwashing, providing hand-sanitizer, requiring facial masks, requiring social distancing, and increasing ventilation?

By Jimmy Norton, CPCU

The COVID-19 pandemic has affected us all in dramatic ways. Companies have closed their doors or reduced operations out of public health concerns. Employees were furloughed or laid off until businesses could operate safely. Fortunately, disaster assistance programs like the PPP helped employers keep people on the payroll during the pandemic.

If you carry a Workers’ Compensation policy, you will soon face your annual audit. The Insurance Auditor will want to see your actual payroll records for the policy term. Here are a few important things to remember if you paid employees to stay home or perform different duties.

Workers’ Compensation policy premiums are based on gross payroll assigned to different classifications based on the type of work performed. Each classification carries a different rate based on the hazards associated with it. How do you classify an employee who sits home while on a paid furlough from work? Ratemakers in the insurance industry feel they have an answer to this question. The National Council on Compensation Insurance (NCCI) announced that payroll for paid furloughed employees can be classified under a special code – 0012. This rule was put in place effective 3/1/20 and will run until 12/31/20. This expiration may be extended depending on the circumstances.

In addition to furloughs, many companies have had to dramatically alter their operations due COVID. If employees were placed in new roles during this time, then companies may be able to reclassify them into different categories. For example, a salesperson moved from outside sales to inside sales while quarantining at home. Chesapeake Employers Insurance provides other examples:

EXAMPLE: A retail store that remains open for delivery of goods but closes the showroom to consumers. Several of the retail showroom employees work from home to assist with phone orders, customer service calls, and related clerical paperwork. These employees may be reassigned to Code 8871—Clerical Telecommuter Employees. In addition, this same employer has other showroom employees delivering goods to customers. These employees would be reassigned to Code 7380—Drivers, Chauffeurs, Messengers, and Their Helpers NOC—Commercial while they are in their new role as delivery drivers. In both situations, the employees’ original job descriptions were included in the applicable store code, but their new job descriptions place them in a new code. Once the employees return to their former roles after the pandemic has passed, their payroll would return to the store code that was assigned before the employer closed the showroom.

In many cases, employees performing more hazardous work will be assigned to less hazardous work due to a change in the company operations. This means that employee’s payroll will go from a higher Work Comp rate to a lower Work Comp rate.

It will be important to notify Insurance Auditors about changes in employee duties as well as paid employees who stayed home on furlough. Auditors WILL REQUIRE that companies maintain separate payroll records, so make sure to start tracking this now. It will be much easier to track the changes now than to have to look back and recalculate at audit time. As with any audit, if separate payroll records are not maintained, then employee payroll is assigned to the highest rated applicable classification.

Good luck and please contact us here at Brock-Norton if you have any questions.

For more information on NCCI’s changes, you can visit their COVID-19 page here: https://www.ncci.com/Articles/Pages/Insights-Coronavirus-FAQs.aspx

Brock-Norton’s website has other COVID-19 information and resources, too. http://www.brocknorton.com/covid-19.html

If you carry a Workers’ Compensation policy, you will soon face your annual audit. The Insurance Auditor will want to see your actual payroll records for the policy term. Here are a few important things to remember if you paid employees to stay home or perform different duties.

Workers’ Compensation policy premiums are based on gross payroll assigned to different classifications based on the type of work performed. Each classification carries a different rate based on the hazards associated with it. How do you classify an employee who sits home while on a paid furlough from work? Ratemakers in the insurance industry feel they have an answer to this question. The National Council on Compensation Insurance (NCCI) announced that payroll for paid furloughed employees can be classified under a special code – 0012. This rule was put in place effective 3/1/20 and will run until 12/31/20. This expiration may be extended depending on the circumstances.

In addition to furloughs, many companies have had to dramatically alter their operations due COVID. If employees were placed in new roles during this time, then companies may be able to reclassify them into different categories. For example, a salesperson moved from outside sales to inside sales while quarantining at home. Chesapeake Employers Insurance provides other examples:

EXAMPLE: A retail store that remains open for delivery of goods but closes the showroom to consumers. Several of the retail showroom employees work from home to assist with phone orders, customer service calls, and related clerical paperwork. These employees may be reassigned to Code 8871—Clerical Telecommuter Employees. In addition, this same employer has other showroom employees delivering goods to customers. These employees would be reassigned to Code 7380—Drivers, Chauffeurs, Messengers, and Their Helpers NOC—Commercial while they are in their new role as delivery drivers. In both situations, the employees’ original job descriptions were included in the applicable store code, but their new job descriptions place them in a new code. Once the employees return to their former roles after the pandemic has passed, their payroll would return to the store code that was assigned before the employer closed the showroom.

In many cases, employees performing more hazardous work will be assigned to less hazardous work due to a change in the company operations. This means that employee’s payroll will go from a higher Work Comp rate to a lower Work Comp rate.

It will be important to notify Insurance Auditors about changes in employee duties as well as paid employees who stayed home on furlough. Auditors WILL REQUIRE that companies maintain separate payroll records, so make sure to start tracking this now. It will be much easier to track the changes now than to have to look back and recalculate at audit time. As with any audit, if separate payroll records are not maintained, then employee payroll is assigned to the highest rated applicable classification.

Good luck and please contact us here at Brock-Norton if you have any questions.

For more information on NCCI’s changes, you can visit their COVID-19 page here: https://www.ncci.com/Articles/Pages/Insights-Coronavirus-FAQs.aspx

Brock-Norton’s website has other COVID-19 information and resources, too. http://www.brocknorton.com/covid-19.html

Businesses all over the Washington Metropolitan area preparing to re-open and we want to make sure you are ready. Brock-Norton has created a “Re-Opening” Handbook to help you plan and manage re-opening in accordance to State and CDC Guidelines for the safety and wellbeing of your employees and customers alike. This handbook contains provisions on cleaning, social-distancing and state specific information (MD, DC and VA) to help you get back to business.

| re-opening_handbook..pdf | |

| File Size: | 659 kb |

| File Type: | |

Harford Mutual has provided a few flyers with best practices about reopening.

According to the reopening flyers: businesses are starting to reopen, and they’re doing so with the safety of their employees and customers in mind. According to the Centers for Disease Control and Prevention (CDC), COVID-19 is expected to remain a public health threat. Community containment has helped to slow the spread of this disease throughout the country, and we will need to continue to focus on these efforts. As our country slowly reinstates parts of the workforce, critical strategies need to be considered in anticipation of returning to business operations.

(c) Harford Mutual Insurance Company

According to the reopening flyers: businesses are starting to reopen, and they’re doing so with the safety of their employees and customers in mind. According to the Centers for Disease Control and Prevention (CDC), COVID-19 is expected to remain a public health threat. Community containment has helped to slow the spread of this disease throughout the country, and we will need to continue to focus on these efforts. As our country slowly reinstates parts of the workforce, critical strategies need to be considered in anticipation of returning to business operations.

(c) Harford Mutual Insurance Company

|

| ||||||||||||

|

| ||||||||||||

| manufacturing.pdf | |

| File Size: | 135 kb |

| File Type: | |

SERVICE: CORONAVIRUS CLEANING, DISINFECTION & FOGGING

|

If you are looking for cleaning and disinfection services, please keep Coventry Services in mind.

Coventry Services provides Coronavirus cleaning, disinfection, air fogging, and sanitization services in the Washington DC and Baltimore Metro areas. Coventry Services provides biohazard remediation services such as the microbial remediation of mold, fungi, and viruses. We use CDC and EPA-registered industrial strength disinfectant products with broad spectrum kill claims to eliminate viruses, in both our air fogging machines, and during wipe down cleaning. Continue to read about their services on their website. |

Resources and Best Practices

|

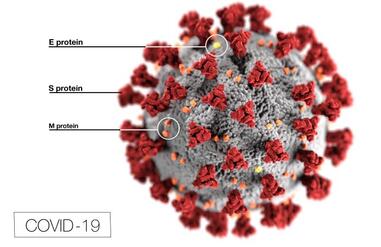

Coronaviruses are a large family of viruses common in humans and many different species of animals, including camels, cattle, cats and bats. Rarely, animal coronaviruses can infect people and then spread between people, such as with Middle East Respiratory Syndrome (MERS) and Severe Acute Respiratory Syndrome (SARS). The 2019 Novel Coronavirus (COVID-19) began spreading person to person in China and, more recently, in countries outside China, including the United States.

The Centers for Disease Control and Prevention (CDC) has issued a document titled Interim Guidance for Businesses and Employers to Plan and Respond to 2019 Novel Coronavirus (COVID-19), February 2020 to help prevent workplace exposures to acute respiratory illnesses, including COVID-2019, in non-healthcare settings. The guidance recommends actions employers can take now and provides planning considerations if there are more widespread, community outbreaks of COVID-2019. The interim guidance is based on what is currently known about COVID-2019. The CDC will update this interim guidance as needed and as additional information becomes available. The Occupational Safety and Health Administration (OSHA) has also developed a COVID-19 Resource webpage which provides information for workers and employers about the evolving coronavirus outbreak. The information includes links to interim guidance and other resources for preventing exposures to, and infections with, COVID-2019. HYGIENE ETIQUETTE Hygiene etiquette involves practices that prevent the spread of illness and disease. A critical time to practice good hygiene etiquette is when you are sick, especially when coughing or sneezing. Serious respiratory illnesses are easily spread by:

To help stop the spread of germs:

EMPLOYER AND EMPLOYEE PRACTICES Employers should:

Employees should:

Finally, the COVID-19 outbreak is an evolving situation, with continuously updated information, guidance. Employers should consult the CDC and their state health department for the most up-to-date planning and response information. For more information visit:

©2020 by the Utica Mutual Insurance Company, all right reserved. |

The Effects of Coronavirus on your BusinessWill insurance cover my loss of revenue?

What if my employees get sick? How Business Insurance may (or may not) respond to losses resulting from the spread of Coronavirus. |

BEGIN YOUR APPLICATION HERE

NOTE: Should you have any questions regarding the loan, or to schedule a virtual counseling session via Zoom, please send the Mason Small Business Development Center Team an email at [email protected].

Applicants may apply online, receive additional disaster assistance information and download applications above. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email [email protected] for more information on SBA disaster assistance. Individuals who are deaf or hard‑of‑hearing may call (800) 877-8339. Completed applications should be mailed to U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

Items Required for Applications

NOTE: Should you have any questions regarding the loan, or to schedule a virtual counseling session via Zoom, please send the Mason Small Business Development Center Team an email at [email protected].

Applicants may apply online, receive additional disaster assistance information and download applications above. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email [email protected] for more information on SBA disaster assistance. Individuals who are deaf or hard‑of‑hearing may call (800) 877-8339. Completed applications should be mailed to U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

Items Required for Applications

- Loan application (SBA Form 5), completed and signed (this is electronic/online in the portal). To see what the form looks like, an example can be found here.

- Tax Information Authorization (IRS Form 4506-T), completed and signed by each applicant, each principal owning 20 percent or more of the applicant business, each general partner or managing member; and, for any owner who has more than 50 percent ownership in an affiliate business. Affiliates include, but are not limited to, business parents, subsidiaries, and/or other businesses with common ownership or management.

- Complete copies, including all schedules, of the most recently filed Federal income tax returns for the applicant business; an explanation if not available

- Personal Financial Statement (SBA Form 413) completed, signed, and dated by the applicant, each principal owning 20 percent or more of the applicant business, and each general partner or managing member.

- Schedule of Liabilities listing all fixed debts (SBA Form 2202 may be used).

- Loan amounts are available up to $2,000.000 and will be provided in the form of term loans only, no lines of credit.

- The purpose is restricted to working capital only. Funds can be used to make existing debt payments, however, cannot be used for payments to federally insured loans (existing SBA loans), for existing federally insured loans, the borrower must request a payment different from their respective financial institution.

- Business expansion; equipment purchase or funding prior year losses are not eligible uses.

- Terms up to 30 years with NO prepayment penalties.

- Interest rates are 3.75% fixed for eligible for-profit businesses and 2.75% for eligible nonprofit businesses (please refer to the PowerPoint for business type eligibility).

- Loans up to $25,000 do not require collateral.

- For loan amounts over $25,000 the SBA will place liens on available collateral including but not limited to business assets and real estate, however, no consideration will be given to the value of the collateral nor the position (second third or fourth lien).

- All fees for such loans are waived with the exception of pass-through expenses (lien search; recordation etc.).

- The current estimated timeline for processing is 18 – 21 days for a decision to be made, 30 – 45 days to close and fund.

- Loans will not be automatically approved, basic underwriting will apply and the company must be able to show the ability to repay the debt on a historic basis.

OSHA Issues Guidance on COVID-19 Exposure Risk by Industry

A new OSHA chart outlines safety steps to take based on worker exposure risk by industry. The level of exposure will have bearing on whether COVID-19-related Work Comp claims are covered. https://www.osha.gov/Publications/OSHA3993.pdf

|

Written By: Jimmy Norton, CPCU

COVID-19 has arrived here in the US, and people are wondering how it will affect them. At this point, the CDC says that "the immediate risk of being exposed to the virus that causes COVID-19 is thought to be low." However, public reaction to the threat of a pandemic can negatively affect your business. Several of my clients are asking how their business insurance will protect them. The spread of Coronavirus is a developing situation, so things may change quickly. Please monitor the CDC website closely for updates. I've been studying insurance industry articles on how different policies may respond to Coronavirus-related claims. Naturally, coverage for any claim depends upon the specific circumstances. Please don't interpret this article as proof positive of any insurance protection. These are just my thoughts as I study this topic. |

|

LOSS OF REVENUE

Fear of infection may keep people at home. If people aren't going out to meet, eat, shop and exercise, then revenue will decrease. The insurance industry treats this as a business risk and cannot provide coverage against this financial loss. Insurance policies require that there be some physical damage or Government mandate to trigger coverage.

Business Interruption insurance covers loss of net income and continuing operating expenses if your business cannot operate after a loss. This coverage requires that there be a direct, physical loss at your premises - or at the premises of a business on which your company revenue depends. The presence of an infectious disease may not be considered direct, physical damage and therefore not trigger the Business Interruption coverage.

Moreover, many Property policies contain exclusions for viruses and bacteria, so these will prevent coverage for most Coronavirus-related Interruption claims.

A company may not suffer a direct physical loss, but its income can be affected if public access is restricted due to the mandate of a Civil Authority. There is an insurance coverage that applies to this - aptly named "Business Income due to Civil Authority." It requires that access to your premises be specifically prohibited by order of a civil authority "as the direct result of a Covered Cause of Loss to property in the immediate area" of your premises. If the Government states that people cannot go to certain establishments or areas, then it's possible that this coverage could apply. Again, the Coronavirus infection trigger would have to meet your policy definition of "covered cause of loss." If your policy has a virus exclusion, then it may apply here, too.

WORKERS COMPENSATION

What if my employees get Coronavirus while at work? State Work Comp Commissions may have to decide the answer to this question. If an employee files a Work Comp claim for Coronavirus, they would need to show that illness "arose out of and was in the course and scope of the employment" and "caused by conditions peculiar" to the work. In a public health situation, it might be difficult to prove that the employee's exposure to Covid-19 was peculiar to their employment for your company - unless you are in a healthcare-related industry. In the event of such a claim, your Work Comp carrier would investigate and either grant benefits or issue a denial based on the Work Comp laws of your state.

Here is a great article about this topic if you'd like to read a little more about it.

LIABILITY

How could your company be sued as a result of a Coronavirus infection? Would General Liability provide coverage if someone alleges that they were infected at my business? Such a claim might be difficult to prove due to the very public nature of this virus. However, people have sued for worse reasons. General Liability policies respond to bodily injury or illness claims. Many GL policies contain an exclusion for communicable diseases that would prevent coverage for such a claim. Check your policy or ask your Agent if yours includes such an exclusion.

Fear of the disease may bring claims of discrimination or harassment by individuals who were denied services from your business. Employees with a cough may be ostracized or sent home out of fear of infecting the rest of the office. Asian-Americans have been victimized by racist and discriminatory attacks.

Allegations of discrimination and harassment are covered under an Employment Practices Liability policy. We have a blog post on this coverage. Click here for further reading.

CYBER

Beware of emails purporting to be from the World Health Organization (WHO) or other agencies asking for sensitive information or directing you to websites with important virus information. These emails may contain attachments or links for "important updates." Hackers are taking advantage of public concern over Coronavirus. The links and attachments may release ransomware onto your computer.

The WHO issued a warning about this on their website.

Their warning states:

The World Health Organization will:

Beware that criminals use email, websites, phone calls, text messages, and even fax messages for their scams.

You can verify if communication is legit by contacting WHO directly.

Contact WHO

Report a scam

A Cyber Liability policy that includes coverage for Cyber Extortion will respond to claims from a ransomware attack. Check your policy or ask your Agent about including the coverage in your policy.

(source: https://www.corvusinsurance.com/news-and-insights/the-cyber-threat-of-covid-19/?utm_content=119940438&utm_medium=social&utm_source=linkedin&hss_channel=lcp-16190758)

MAKE PLANS NOW, DON'T RELY ON INSURANCE

The best way to prevent or minimize a loss is to plan ahead. As you've seen in my comments above, you may not be able to rely on an insurance policy to repay you for a Coronavirus-related loss. Risk Management will be your best defense. The CDC has a web page that provides guidance for businesses and employers to plan and respond to this disease. This is a good place to start.

If you send your employees on travel, be sure to check the CDC's Travelers' Health page first.

We'll be sure to update you as we learn more about this issue. If you have any questions, please contact us here at Brock-Norton Insurance.

Fear of infection may keep people at home. If people aren't going out to meet, eat, shop and exercise, then revenue will decrease. The insurance industry treats this as a business risk and cannot provide coverage against this financial loss. Insurance policies require that there be some physical damage or Government mandate to trigger coverage.

Business Interruption insurance covers loss of net income and continuing operating expenses if your business cannot operate after a loss. This coverage requires that there be a direct, physical loss at your premises - or at the premises of a business on which your company revenue depends. The presence of an infectious disease may not be considered direct, physical damage and therefore not trigger the Business Interruption coverage.

Moreover, many Property policies contain exclusions for viruses and bacteria, so these will prevent coverage for most Coronavirus-related Interruption claims.

A company may not suffer a direct physical loss, but its income can be affected if public access is restricted due to the mandate of a Civil Authority. There is an insurance coverage that applies to this - aptly named "Business Income due to Civil Authority." It requires that access to your premises be specifically prohibited by order of a civil authority "as the direct result of a Covered Cause of Loss to property in the immediate area" of your premises. If the Government states that people cannot go to certain establishments or areas, then it's possible that this coverage could apply. Again, the Coronavirus infection trigger would have to meet your policy definition of "covered cause of loss." If your policy has a virus exclusion, then it may apply here, too.

WORKERS COMPENSATION

What if my employees get Coronavirus while at work? State Work Comp Commissions may have to decide the answer to this question. If an employee files a Work Comp claim for Coronavirus, they would need to show that illness "arose out of and was in the course and scope of the employment" and "caused by conditions peculiar" to the work. In a public health situation, it might be difficult to prove that the employee's exposure to Covid-19 was peculiar to their employment for your company - unless you are in a healthcare-related industry. In the event of such a claim, your Work Comp carrier would investigate and either grant benefits or issue a denial based on the Work Comp laws of your state.

Here is a great article about this topic if you'd like to read a little more about it.

LIABILITY

How could your company be sued as a result of a Coronavirus infection? Would General Liability provide coverage if someone alleges that they were infected at my business? Such a claim might be difficult to prove due to the very public nature of this virus. However, people have sued for worse reasons. General Liability policies respond to bodily injury or illness claims. Many GL policies contain an exclusion for communicable diseases that would prevent coverage for such a claim. Check your policy or ask your Agent if yours includes such an exclusion.

Fear of the disease may bring claims of discrimination or harassment by individuals who were denied services from your business. Employees with a cough may be ostracized or sent home out of fear of infecting the rest of the office. Asian-Americans have been victimized by racist and discriminatory attacks.

Allegations of discrimination and harassment are covered under an Employment Practices Liability policy. We have a blog post on this coverage. Click here for further reading.

CYBER

Beware of emails purporting to be from the World Health Organization (WHO) or other agencies asking for sensitive information or directing you to websites with important virus information. These emails may contain attachments or links for "important updates." Hackers are taking advantage of public concern over Coronavirus. The links and attachments may release ransomware onto your computer.

The WHO issued a warning about this on their website.

Their warning states:

The World Health Organization will:

- never ask you to login to view safety information

- never email attachments you didn’t ask for

- never ask you to visit a link outside of www.who.int

- never charge money to apply for a job, register for a conference, or reserve a hotel

- never conduct lotteries or offer prizes, grants, certificates or funding through email

- never ask you to donate directly to emergency response plans or funding appeals.

Beware that criminals use email, websites, phone calls, text messages, and even fax messages for their scams.

You can verify if communication is legit by contacting WHO directly.

Contact WHO

Report a scam

A Cyber Liability policy that includes coverage for Cyber Extortion will respond to claims from a ransomware attack. Check your policy or ask your Agent about including the coverage in your policy.

(source: https://www.corvusinsurance.com/news-and-insights/the-cyber-threat-of-covid-19/?utm_content=119940438&utm_medium=social&utm_source=linkedin&hss_channel=lcp-16190758)

MAKE PLANS NOW, DON'T RELY ON INSURANCE

The best way to prevent or minimize a loss is to plan ahead. As you've seen in my comments above, you may not be able to rely on an insurance policy to repay you for a Coronavirus-related loss. Risk Management will be your best defense. The CDC has a web page that provides guidance for businesses and employers to plan and respond to this disease. This is a good place to start.

If you send your employees on travel, be sure to check the CDC's Travelers' Health page first.

We'll be sure to update you as we learn more about this issue. If you have any questions, please contact us here at Brock-Norton Insurance.

Here are Brock-Norton we are committed to keeping our clients abreast of any updates or resources that we can provide during this challenging time. As you are aware, the outbreak of COVID-19 has placed considerable stress not only on individuals and families but the business community as well. With mandatory closures becoming more commonplace, we know many are concerned about cash-flow and future revenue. With that said, if your business has been adversely impacted by the coronavirus pandemic, we want to help. At this time, we can assist you by:

We understand that these are unprecedented times, and therefore will require unprecedented solutions. We hope that you will look for opportunities to stay positive and spread love and joy wherever and whenever possible. If you can stay quarantined, please do so out of consideration for healthcare workers and those with compromised immune systems. We will continue to provide resources as they become available.

Please do not hesitate to reach out to us if we can be of further assistance. We appreciate your time and look forward to continuing to be of service.

- Reaching out to carrier partners to discuss flexible premium payment options. Several carriers are agreeing to waive late fees and offering extensions on due dates. We can contact your carrier to see what payment arrangements can be made for you.

- Updating policy payroll and sales exposures to reflect the quarantine’s effect on your business. Many policy premiums are based on payroll and gross sales estimates. If you had to lay off or furlough employees due to the closures or had a reduction in work available for current staff, your gross payrolls will decrease. We can review your policies to determine if any adjustments are needed that can reduce your premium.

- Providing options for vendors offering short term lending or loans to assist you in maintaining operations. We have information from companies like Heartland, Complete Business Capital, and the SBA that can provide financial assistance via loans for business owners. Please note that we have no control over any terms or acceptance for any financial products. We are simply here to provide the information if you choose to pursue that avenue.

- Speaking to you about your coverages and how they may potentially respond to claims related to the Coronavirus pandemic. We always strive to help you understand your coverages and how they protect your most valuable investments. We are happy to discuss coverage scenarios and review individual policy language. As always, we cannot guarantee coverage of any claim as the ultimate decision will reside with the carriers and/or courts within your jurisdiction. Please see our article on The Effects of Coronavirus on Your Business for additional information.

We understand that these are unprecedented times, and therefore will require unprecedented solutions. We hope that you will look for opportunities to stay positive and spread love and joy wherever and whenever possible. If you can stay quarantined, please do so out of consideration for healthcare workers and those with compromised immune systems. We will continue to provide resources as they become available.

Please do not hesitate to reach out to us if we can be of further assistance. We appreciate your time and look forward to continuing to be of service.